|

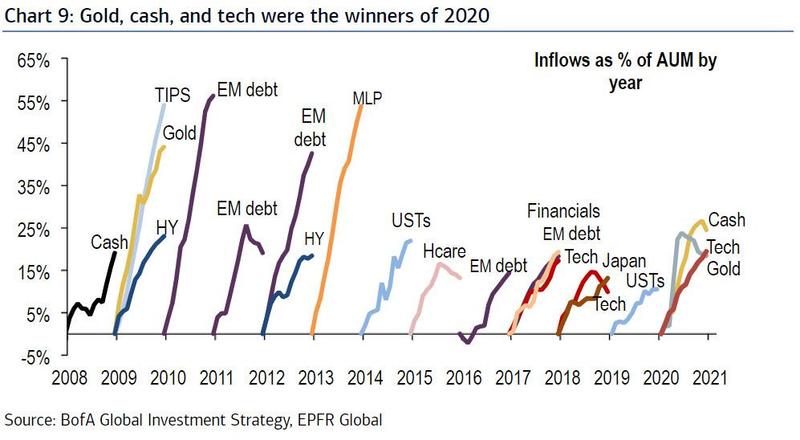

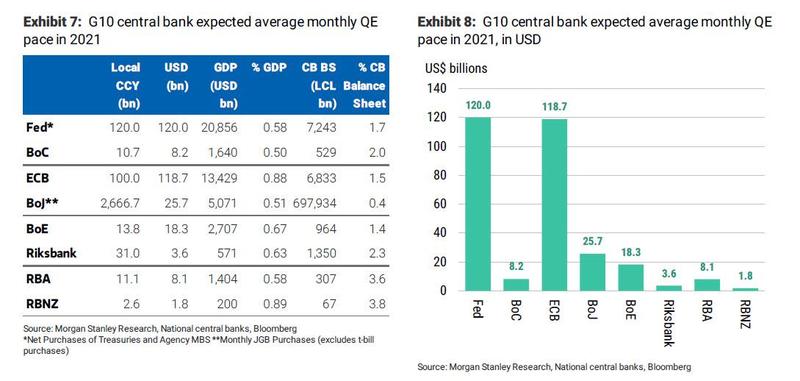

| BofA: Central Banks Are Buying $1.3 Billion In Assets Every Hour, Creating A "Frankenbull" Market |

|

One week after BofA CIO Michael Hartnett issued a "code red" for stocks after publishing a report in which he showed that while current market euphoria has surpassed dot com levels, what was going now is absolutely staggering and it's only getting crazier with each passing day and new all |

|

Dec 13, 2020

by

ZeroHedge

Finance News |

|

| The 2021 Liquidity Supernova: Step Aside Fed - US Treasury Will Unleash $1.3 Trillion In Liquidity |

|

One of the most poignant (and painful to some) lessons of the past decade - especially to contrarian, bearish investors such as Odey and Horseman - is that the Fed can keep print money far longer than any short can remain solvent. |

|

Dec 02, 2020

by

Zero Hedge

Finance News |

|

| Quantitative easing now looks permanent - and has turned central banks into pseudo governments |

|

After a pause of a few months, the world's leading central banks are "printing" money again to try to bolster their economies. Commonly known as quantitative easing or QE, the European Central Bank (ECB) resumed its programme just before the turn of the year. |

|

Jan 28, 2020

by

Valerio Cerretano

Finance News |

|

| The whole banking system is a scam |

|

www.ukipmeps.org | Join UKIP: ukip.datawareonline.co.uk/JoinOnline.aspx?type=1 * European Parliament, Strasbourg, 21 May 2013 * Speaker: Godfrey Bloom MEP, UKIP (Yorkshire & Lincolnshire), Europe of Freedom and Democracy (EFD) group - www.godfreybloommep.co.uk * Joint Debate: Banking union - single supervisory mechanism 1. |

|

Jan 20, 2020

by

Godfrey Bloom - UKIP MEPs

Finance Blogs |

Go to Top